HK_50

| Instrument:hk_50 |

An Overview of China’s Financial Engine – HSI

With a market cap weighted index of 40 of the largest companies traded to date on the Hong Kong Exchange, the Hang Seng Index (HSI) is one of Asia’s biggest indices. Maintained by the Hang Seng Bank, the HSI has been published since 1969, and is the leader of the HKE, covering 65% of its market capitalization. HS members are also classified into one of four sub-indices that include the commerce, utilities, properties and finance industries. The Hang Seng is the most widely quoted barometer for the Chinese stock market and the Hong Kong economy. As Hong Kong’s status is known as a special administrative region of China, there are close ties between their economies and a lot of Chinese companies are listed on the Hong Kong Stock Exchange, still held in a majority by the British financial firm HSBC.

Hang Seng Index Trading information

- MT4 Symbol: HSI

- Trading Time: 01:15-03:59 & 05:00-08:29 & 09:15-17:45

- Country: Hong Kong

- Currency: HKD

- Exchange: HKE

Interesting facts about the HS Index

The Hang Seng Index was first published on the 24th of November 1969 and it is, to this day, the largest indicator of overall market performance in Hong Kong. There are several indices belonging to the Hang Seng indices family including: Hang Seng China Enterprises Index, Hang Seng China AH Index Series, Hang Seng China H-Financials Index, Hang Seng Composite Index Series, Hang Seng China A Industry Top Index, Hang Seng Corporate Sustainability Index Series and Hang Seng Total Return Index Series.

The chairman of the Hang Seng Bank, Ho Sin Hang conceived the idea of creating the Hang Seng Index as the “Dow Jones” of Hong Kong. Upon publication its base of 100 points was set equivalent to the stocks’ total value as of market close on 31 July, 1964. The all-time low this index experienced was 58.61 points on August 31, 1967. Later the base value was established and the Hang Seng passed the 10,000-point milestone seen in October 18, 2007, while reaching it’s all-time high a few days later, on the 30th of October 2007, at 31,958.41 points.

Index Composition of HSI

| Name of Company | Industry | Weight (%) |

|---|---|---|

| HSBC Holdings | Financials | 10.29 |

| Tencent | Information Technology | 9.59 |

| AIA | Financials | 8.51 |

| CCB | Financials | 8.24 |

| China Mobile | Telecommunications | 5.15 |

| Sector | Weight (%) |

|---|---|

| Finance | 48.71% |

| Properties and Construction | 11.49% |

| Information Technology | 10.96% |

| Telecommunications | 5.95% |

| Energy | 5.61% |

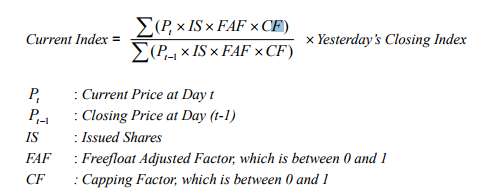

Index Formula

The factors influencing overall index price of the HSI

As with other indices trading, there are many macro and micro-economic factors that can influence the Hang Seng Index. As it has a close correlation to the Chinese economic current, the Chinese market has a great and almost immediate impact on the index. One economic shift for example would be the Yuan/Dollar peg being removed not in its entirety as they will be pegging it to a basket of currencies and not just the USD. The impact of the Yuan devaluation in August 2015 by the People’s Bank of China (PBOC) shook the markets with three consecutive devaluations of the Yuan renminbi (CNY), remaining 30% lower than its previous value.

With the CNY/USD peg being removed as well as the Yuan devaluation (as explained above) experts are confident these changes did add value to the country as well as a boost in support of a better economy. These changes did have a direct effect and impact on the Hang Seng Index. Political events have an equal role to play. Even when they are not in direct correlation to the HSI, they do influence index price dynamics. The best example is the announcement of Brexit which led to a 1000 points drop in the Index.

Advantages of trading the HSI with AvaTrade

Start trading with AvaTrade, your trusted Forex & CFDs broker, and benefit from:

- Up to leveraged trading and competitive spreads

- Free trading education to make sure you enter the markets with complete confidence

- Advanced trading platforms to suit your trading needs

- The innovative AvaTradeGO app allows you to trade on HSI from anywhere

Are you ready? Sign up today and enjoy the benefits of trading with a regulated, award-winning broker!