How to trade stocks

Understanding the Stock Market

If you are unfamiliar with the stock market, then this trader’s guide will assist you in understanding this market and how you can easily trade stocks with AvaTrade online. The stock market is a giant international market where stocks, or shares of ownership of a company, are traded.

The vast majority of this trading is now done online; however, in the past, it was done over the phone, or in person, directly with one’s broker. All around the world, people trade stocks, hoping to profit from price changes in stocks over time. Stock prices change continuously during trading hours, offering traders many lucrative trading opportunities.

However, before we get started with the specifics of the stock market, it’s important to point out that when you trade stocks in a conventional sense, you’re buying into a company, in very small amounts. The more stocks you own, the greater your share in the company. Publicly traded stocks number in the thousands, and many stocks are being listed or delisted each and every day.

The value of a stock is dependent on a wide variety of factors, including the fundamentals of the company, socio-economic issues, geopolitical issues, inflation, unemployment, taxation, and a host of others. At any given time, all of these factors are working together – often in opposite directions – to influence the price of the company’s stock. But perhaps the biggest drivers of stock prices are speculation and perception. The more people that believe a stock is likely to move up or down, the greater the likelihood that they will move the stock price in a particular direction.

The value of a stock is dependent on a wide variety of factors, including the fundamentals of the company, socio-economic issues, geopolitical issues, inflation, unemployment, taxation, and a host of others. At any given time all of these factors are working together – often in opposite directions – to influence the price of the company’s stock. But perhaps the biggest drivers of stock prices are speculation and perception. The more people that believe a stock is likely to move up or down, the greater the likelihood that they will move the stock price in a particular direction.

What determines stock value?

Stock prices are only calculated when a company decided to go public and makes its initial public offering. The company will primarily pay an investment bank that makes use of complex valuation techniques that determine the results of how many shares will be offered and at what exact price.

As a company’s total value is its Market Capitalization that is represented by its Stock Price once the company goes public this is published on the stock markets. Market capital is equal to the stock price, but multiplied by the actual number of shares. E.g.: If a company’s value is estimated at $100 million it may issue 10 million shares at $10 per share.

Once the IPO is over and a stock is trading on the stock exchange its price will change each day as a function of the supply of stock and the demand from investors. Shares that have a high demand see their price go higher, but if investors don’t see a bright future for a company the stock will see light demand and the price could decrease as a result.

At its most basic a stock price is determined by supply and demand. This is true in any market dynamic where buyers and sellers determine the market price of an asset through their negotiations. When buyers are optimistic and demand is high they will be willing to pay more and prices will rise. But when they aren’t very enthusiastic demand falls, and since investors aren’t willing to pay as much the price falls too.

Analysts will also use quantitative techniques to predict the future price of a stock. These models use the theory of the time value of money (TVM) and are based on the concept that the current price of a stock is equal to the sum total of its earnings and dividend payments discounted to present value. This is not an absolute computation however, which is why analyst price targets for a stock can vary so greatly.

Market Cap is Not the True Value of a Company or Stock

You’ve likely heard stocks described as large-cap and small-cap before, and these are descriptive of the total value of all outstanding shares in a company. It is not a measurement of the equity value of the company however. To determine the euity value of a company a complete fundamental analysis of the company’s financials must be done. The market cap is an arbitrary measurement used to reflect the value of a business, but it tends to be inaccurate as a way to value a business. This is because stocks are rarely fairly valued. Instead they are almost always undervalued or overvalued, and that’s part of the reason the price of stocks is continually changing.

Plus, even though it tells you how much it would cost to buy all of a company’s shares, the market cap is not an accurate representation of how much the company could be worth in a merger or acquisition.

So, while market cap is often used to describe the market value of a company, it is really only the market value of the company’s stock, not the market value of the company which includes all of its assets and debts.

Why CFD Stocks Trading is so much easier

When you trade CFD stocks like Google, Coca Cola, Apple or Barclays, you’re not buying shares in a company; you are agreeing to a contract (CFD) with the forex broker to settle the difference in value between the entry/exit prices of that particular stock. Prices are always moving up and down, but traders can always take advantage of these price fluctuations, even in a bearish market. To learn more, visit our short selling page.

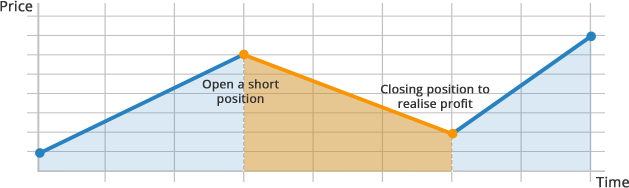

Making a profit in a bearish market

Since you’re not taking possession of the tradable asset, there is leverage of up to 5:1, which means that for a small investment you can trade substantially larger stock volumes. Where you might only be able to purchase 100 shares of a stock in the traditional sense, when trading CFDs with leverage the same investment will allow you to control 500 shares. This is a huge difference because in the first case a $1 move in the stock is worth $100, but in the second case a $1 move is worth $500. That means on a $1,000 total investment the first case will give you a 10% return, which is nice, but the second case will give you a 50% return, which is outstanding!

It is important to understand though that CFD online trading stock has an upside and a downside, and sensible trading practices are encouraged at all times.

Find a Successful Stock Trading Formula

There are far too many stock trading strategies to list them all here, but it is important to understand the importance of finding a successful stock trading formula before you risk your own money in the markets. The easiest way to test out your strategies is by taking advantage of one of our demo accounts, which allow you to place trades using “virtual” currency. Once you find a strategy that’s consistently profitable this way you know you’ll be able to use the strategy with a high chance of success in your real account.

There are also some universal rules about successful stock trading formulae. These are rules that apply to nearly all the successful trading strategies. Here are seven of those rules:

- Don’t risk more than 2% of your account balance on a single trade

- Start small, trading just 1 or two stocks until you gain experience

- Avoid penny stocks (AvaTrade only offers the best large-cap stocks)

- Use limit orders for the best entries

- Protect your trades with stop-loss orders

- Don’t get greedy

- Stick to your trading plan

Remember too that any successful trading strategy doesn’t just consider the best time to buy, it also has rules to specify when to sell. There are too many examples of traders who are great at entries, but fail to make money because they know nothing about when to exit their trades As a result they often watch winners turn into losers. Don’t be that trader. Find your successful strategy that includes both entry and exit rules.

Advantages of leveraged stock trading

Leveraged trading is an option that has grown immensely in popularity among traders looking for ways to increase their potential returns. It’s also important to understand that when you are using a high risk strategy like leverage, it is important to combine it with increased knowledge and experience. This is how you manage the risk. So what are the benefits of leveraged trading? Let’s have a look:

- Leverage trading enhances your initial capital

- Increase your profit potential but beware of associated risks

- Increases your exposure to the markets on particular position

- Allows you to fully capitalise on market investments

- Leverage also allows traders to offset capital losses from other trading positions

- Using leverage effectively can be pivotal as part of a balanced, well managed trade portfolio

Leverage is commonly thought to increase trading risk because of the way in which it can magnify both gains and losses from a trade. This is theoretically a correct analysis, but it’s the wrong way to consider leverage. In fact, professional traders believe leverage is the most efficient way to deploy their capital. They appreciate the power of leverage because it allows them to undertake larger positions with less capital. There’s no change in the potential profit or loss when leverage is used. It simply reduces the required trading capital, thus freeing up capital for other trades. Consider the trader who wishes to purchase 1,000 shares at $50 per share. If that trader had $50,000 available, he could purchase those shares without leverage, and that’s the only trade he could make. But if he used 1:5 leverage he would nbe able to purchase the same 1,000 shares for just $10,000 and have the remaining $40,000 available for other trades. This is how a professional trader considers leverage, and is the logical way to consider using it.

The Trading Platform is Paramount

One of the most important aspects of trading stocks is the trading platform that you use. We feature several of the most powerful, innovative and robust trading platforms on the market. You’ll be able to make use of multiple trading graphs, management functions and other features to enhance your overall trading experience. Plus, you’ll be able to see your stock portfolio, alongside your indices, fx trading, and commodities portfolio.

We regularly update our traders with the latest news, trading educational resources and market commentary to keep you well informed about the hottest trends, movements and news from the world of stocks trading. Find a Successful Stock Trading Formula before you begin to trade. Know the risks and potential positive outcomes prior to entering a Stock trading position. The use of limit and stop orders as well as leverage have a substantial role to play.

Don’t miss your opportunity ⇒ Trade with a market-leading CFD broker!

How to trade stocks main FAQs

- Do I need to diversify when trading stocks?

The notion of diversification, or spreading your money across a number of market sectors or asset classes, is a concept that applies to investing for the long-term. When you are trading stocks, you are looking to make a profit from the short-term movement of the stock. In this case diversification won’t benefit you, and in some cases, it could even harm your results. If you are looking to profit from the movement in stocks often times it is stocks within the same sector that are making the best moves, which means you’ll often want to concentrate your trading rather than diversify.

- How can I find the best opportunities when trading stocks?

There are always good opportunities in the markets and you don’t have to find the best to make a profit. The very best way to locate stock trading opportunities is to become intimately familiar with the market. The easiest way to do this is to begin with a single sector, like technology or the financial stocks. When you are constantly monitoring the behaviour of a stock or a set of stocks you will begin to notice patterns in the prices that you can take advantage of. Start by creating a small list of 10-20 stocks that you follow on a regular basis and work your way up from there.

- How will I know when to sell my stocks?

You should have a plan for every trade you make. That means knowing why you want to buy or short the stock, where is a good area to place your buy/sell order, and knowing how much the stock will move before you sell. You should already know when to sell before you buy the stock. That means when to sell for a profit, or when to cut your losses. That takes all the emotion out of the trade because your trading decisions won’t be dictated by fear or greed.