Candlestick Patterns

- Candlestick Features

- Types of Candlestick Patterns

- Bullish Candlestick Patterns

- Bearish Candlestick Patterns

- Disadvantages of Trading with Candlestick Patterns

- Final Word – Trade with AvaTrade

What is Candlestick Pattern?

Candles have served humans as sources of light (and sometimes fragrance) for centuries, ever since they were invented. In the financial markets, their purpose can arguably be said to be similar; they light up the path of the asset price and can help traders to detect the good smell of profits. Candlesticks provide comprehensive price information at any time. While line charts represent a smoothened line of closing prices, candlesticks show the opening, closing, high and low prices of any time period.

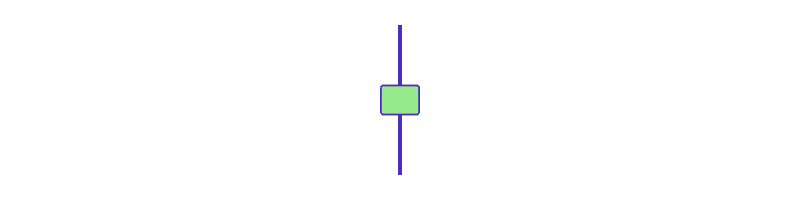

The opening and closing price will be represented by the body of a candlestick, while the extreme (high and low) prices will be represented by wicks. Usually, a candle will be coloured green if the closing price is higher than the opening price; and red, if the closing price is lower than the opening price. Because of the amount of information they provide, candlesticks form the basis of technical analysis. The size and shape of a candlestick tell an important price action story. This is why traders look for candlestick patterns when trading.

A candlestick pattern can be a single or a series of multiple candlesticks that give a comprehensive picture of market sentiment. Depending on where they form on a chart, candlestick patterns help traders to understand the price action of the underlying financial asset to pick out potentially lucrative trading opportunities.

Candlestick Features

When analysing chart patterns, the following factors help to put the prevailing price action in context:

Body Length

The length of a candlestick body represents the distance between the closing and opening prices during a particular time period. Long bodies imply a strong directional movement, while short bodies are an indication of indecision among investors in the market.

Wick Length

Candlestick wicks show the high and low prices achieved during a particular time period. In essence, they show how volatile prices were during that time period. Wick length is analysed relative to body position. For instance, a candlestick with a long lower wick shows that bears tried to push the price lower, but bulls resisted their pressure and drove the price higher. The prior trend is also taken into account when interpreting candlestick patterns. The broader context must be considered because candlestick patterns do not form in isolation.

Types of Candlestick Patterns

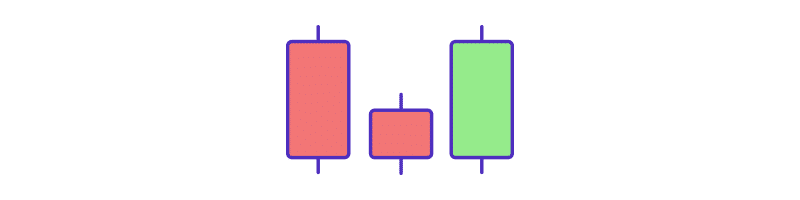

Candlestick patterns are classified according to the types of signals they provide as well as the number of candlesticks that constitute any particular pattern. Thus, there are bullish and bearish patterns, reversal and continuation patterns, as well as single candlestick patterns, dual candlestick patterns and triple candlestick patterns.

When analysing candlestick patterns, it is important to understand the basic candlesticks that explain market psychology. These include:

Spinning Tops

Spinning tops have small bodies but very long lower and upper wicks. The small body implies that there is little difference between the opening and closing prices, while long wicks imply that prices reached extremes in both directions. Spinning tops show that buyers and sellers had a tussle within the time period, with neither group gaining any particular advantage.

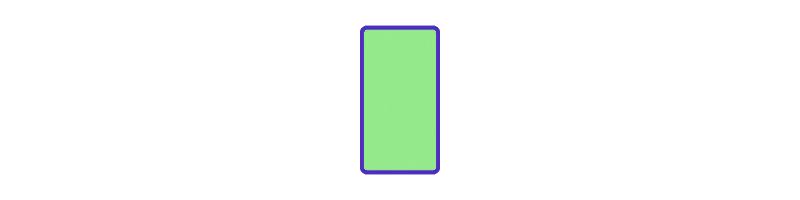

Marubozu

Marubozu candlesticks have long bodies but have no wicks. This means that a green Marubozu will have a similar open and low price as well as a similar close and high price. A green Marubozu is an indication that bulls were in complete control during that particular time period. On the other hand, a red Marubozu will have a similar open and high price as well as a similar close and low price. A red Marubozu indicates that bears were in complete control during that time period.

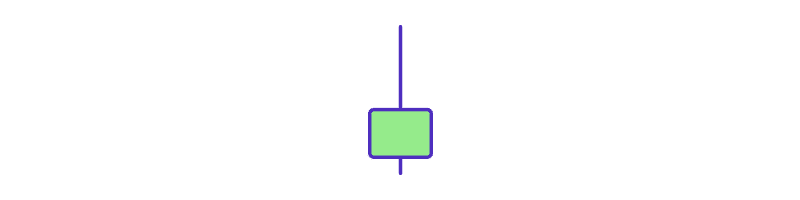

Doji

Doji candlesticks have long wicks but virtually non-existent bodies. This means that opening and closing prices are practically similar. Doji candlesticks denote that neither buyers nor sellers were able to gain an edge during any particular time period. Still, there are different types of doji candlesticks that may provide different alternative price action stories, depending on the position of the wicks.

Bullish Candlestick Patterns

Bullish candlestick patterns occur when prices drift lower and they signal that prices are about to turn or continue higher.

Here are some of the most common bullish candlestick patterns:

Single Candlestick Patterns

These are bullish candlestick patterns that may be described as ‘lone rangers’ because only one candlestick provides the signal. The most common bullish candlestick patterns are:

Hammer

The hammer candlestick has a small body at the upper end of the trading range and a long lower wick. It forms during a downtrend and indicates that sellers tried to push the prices lower, but buyers stepped in to drive prices to near the opening price. The sellers ‘literally’ hammered out a bottom in the market. The hammer candlestick is an indication that buyers are ready to take charge of subsequent time periods.

Inverted Hammer

The inverted hammer candlestick has a small body at the lower end of the trading range and a long upper wick. It forms during a downtrend and indicates that buyers have tried to drive the price higher, but sellers stepped in to push it lower. Still, sellers lacked the momentum to take out the low of the period. The inverted hammer thus signals that buyers could be buoyed by the weakness of the sellers and may take control in subsequent periods.

Dual Candlestick Patterns

These are candlestick patterns that require two consecutive candlesticks to provide trading signals. Here are some of the most common bullish dual candlestick patterns:

Tweezer Bottoms

A tweezer bottom will form after a decline in prices and consists of two candlesticks with bodies at the upper end of the trading range and long lower wicks of almost similar lengths. The first candlestick is usually red, while the second one is usually green. The tweezer bottom candlestick pattern indicates that sellers initially pressured prices lower but faced resistance from buyers who pushed prices higher. The sellers tried again but they were finally overpowered by buyers who pushed prices higher than the opening price.

Bullish Engulfing Pattern

A bullish engulfing pattern is a 2-candlestick formation that will form during a downtrend. The first candlestick will be a bearish one and the second one will be a bullish candlestick that will ‘engulf’ the body of the first one. This means that the open and close prices of the first candlestick will fall within the trading range of the second candlestick. A bullish engulfing pattern indicates that sellers drove prices lower during the first candlestick, but buyers completely overwhelmed them during the second candlestick, as they pushed prices beyond the high of the first candlestick.

Triple Candlestick Patterns

These are candlestick patterns that require three consecutive candlesticks to provide trading signals. Here are some of the most common bullish triple candlestick patterns:

Morning Star

The morning star is a 3-candlestick pattern that forms in a downtrend as follows: the first candle is bearish; the second candle has a small body, and the third candle is bullish and closes beyond the midpoint of the first candle. The morning star indicates that sellers were in control during the first candlestick, but there was indecision during the second candlestick; the battle was eventually won by buyers on the third candlestick, as they pushed prices higher.

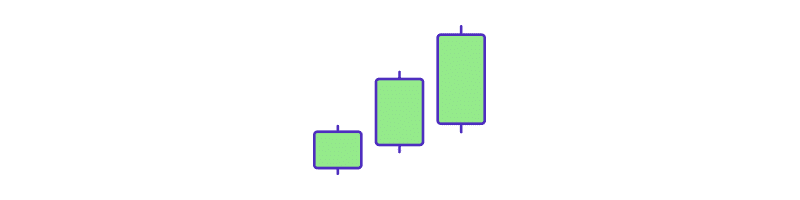

Three White Soldiers

The three white soldiers pattern forms when there are three consecutive bullish candlesticks in the market. Each candlestick opens within the body of the preceding candlestick and closes beyond its high price. The first candlestick is known as the reversal candlestick, with the following two candlesticks confirming a bullish momentum in the market.

Bearish Candlestick Patterns

Bearish candlestick patterns form in an uptrend or when prices edge higher. They signal that prices are about to turn or continue lower.

Here are some of the most common bearish candlestick patterns:

Single Candlestick Patterns

Here are some of the most common bearish single candlestick patterns:

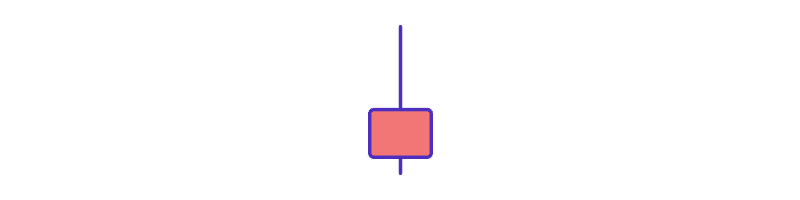

Shooting Star

The shooting star candlestick has a small body at the lower end of the trading range and a long upper wick. It forms during an uptrend and indicates that buyers tried to drive prices higher, but sellers stepped in to pressure prices lower to near the opening price. The shooting star candlestick is a sign that sellers are ready to be in control during the succeeding time periods.

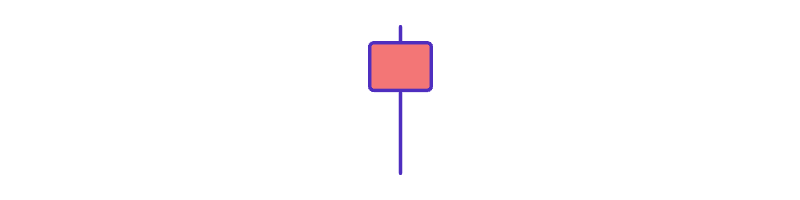

Hanging Man

The hanging man candlestick has a small body at the upper end of the trading range and a long lower wick. It forms during an uptrend and indicates that sellers tried to pressure the price lower, but buyers stepped in to support it higher. However, the buyers could only push it to near the open price. Therefore, the hanging man signals that sellers are outnumbering buyers and prices may be pressured lower in subsequent time periods.

Dual Candlestick Patterns

Here are some of the most common bearish dual candlestick patterns:

Tweezer Tops

A tweezer top will form in an uptrend and consists of two candlesticks with bodies at the lower end of the trading range and long upper wicks of almost similar lengths. The first candlestick is bullish, while the second one is bearish. The tweezer top candlestick pattern indicates that buyers initially pushed prices higher, but sellers managed to pressure the prices lower. Another attempt by buyers to push the price higher was completely thwarted by sellers who pressured the prices lower than the open price.

Bearish Engulfing Pattern

A bearish engulfing pattern is a 2-candlestick formation that will form in an uptrend. The first candlestick is bullish, while the second one is a bearish candlestick that will ‘engulf’ the body of the first one. A bearish engulfing pattern indicates that buyers pushed the prices higher during the first candlestick, but sellers overpowered them during the second candlestick, pressuring the prices lower beyond the low of the first candlestick.

Triple Candlestick Patterns

Here are some of the most common bearish triple candlestick patterns:

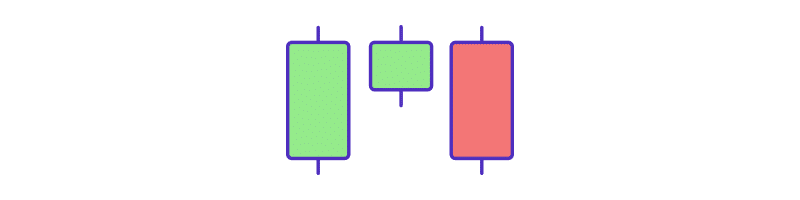

Evening Star

The evening star is a 3-candlestick pattern that forms in an uptrend as follows: the first candle is bullish; the second candle has a small body, and the third candle is bearish and closes beyond the midpoint of the first candle. The evening star indicates that buyers were in control during the first candlestick, followed by indecision during the second candlestick; the sellers eventually took charge in the third candlestick and pressured the prices lower.

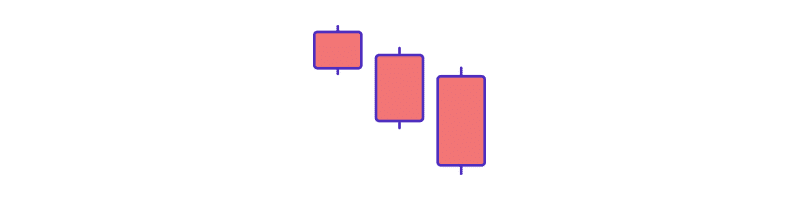

Three Black Crows

The three black crows pattern forms when there are three consecutive bearish candlesticks in the market. Each candlestick opens within the body of the preceding candlestick and closes beyond its low price. The first candlestick is known as the reversal candlestick, with the following two candlesticks serving as confirmation of bearish momentum in the market.

Disadvantages of Trading with Candlestick Patterns

Candlestick patterns provide information on raw price action, but they also have their limitations. Candlestick patterns can generate false signals in volatile markets, characterised by gaps and sudden price surges.

And because they help to analyse the current or most recent price action, they do not provide information on the big picture. This means that it is easy to get trapped in a trade where the long-term broader sentiment of the market was not considered. Basically, candlestick patterns are no holy grail and should not be used in isolation. To boost the effectiveness of candlestick patterns, it is important to seek confluences with other analysis methods. The best way is to pair them with support and resistance levels because candlestick patterns provide directional signals.

Candlestick patterns can also be combined with technical analysis tools, such as Oscillators that signal overbought and oversold conditions in the market, as well as trend-following indicators, such as Parabolic SAR, that will help identify trading opportunities in trending markets. As well, candlestick patterns should be traded with strict risk management plans that will help limit risks as well as enhance profits. Risk management involves setting optimal stop loss and take profit orders.

Final Words

Trading with candlestick patterns is an invaluable skill that can help any trader to significantly boost their trading accuracy. They can provide invaluable market sentiment information as well as serve as confirmation tools for signals generated by other types of price analyses. It is important to research the numerous candlestick patterns available and the market psychology behind their formation to take advantage of more trading opportunities in the market.

Main Candlesticks Patterns FAQ

- Which candlestick pattern is most reliable?

Candlestick patterns are the most popular type of charting patterns and for good reason. Every minor and major top and bottom in the markets is marked by a chart pattern. The problem is identifying those patterns and finding the most reliable ones. Among the easiest to identify is the doji, which looks much like a plus sign and often comes at the end of a trend. Another easy-to-identify and reliable pattern is the engulfing pattern, which is a two candle pattern that has the second candle completely engulfing the first, indicating a reversal in trend.

- Do candlestick patterns work?

Traders certainly believe candlestick patterns work. That’s obvious by even the most cursory look in any trading forum, where various candlestick patterns and strategies abound. But do candlestick patterns work? The truth is that they do work, but not all the time. The trader’s job then is to understand early when the candlestick pattern is working and either enter a trade or stick with an already opened trade, or exit their trade to minimize losses. Candlestick patterns work as long as traders put in the work to understand them.

- What is the most powerful candlestick pattern?

The most powerful candlestick pattern according to many traders is known as the Pinocchio bar or simply “Pin bar.” It can occur at either tops or bottoms and goes by different names depending on where it occurs on a chart. These names include Hammer, Inverted Hammer, Shooting Star and the Hanging Man. In each case the candlestick is defined by a large wick and a small body and it comes at the end of either an up move or down move and signals market exhaustion.

** Disclaimer – While due research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.