MACD indicator

- MACD Overview

- How to set it up

- MACD strategy for newbies

- Convergence/divergence and how to apply it in trading

- Moving average strategy

- MACD advanced strategy

MACD Trading Strategies

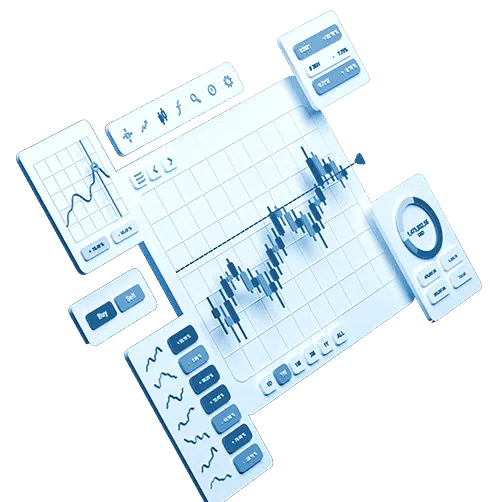

MACD indicator is considered to be one of the central indicators in technical analysis; it is the second most popular tool after Moving Average. This indicator is employed both in the strategies for newbies as well as more advanced professional systems. What are the MACD indicator advantages, how can you set it up and make use of it in your trading?

MACD: principle and peculiarities

MACD indicator is an oscillator, although it’s often called a trend indicator or even a “trend oscillator”. It happens because MACD is based on two moving average indicators applied directly on the chart (they are not displayed in the MACD chart, only their readings are used).

MACD itself is displayed in a separate window under the chart. It looks like a histogram with an auxiliary line. The histogram shows that divergence of two moving averages. If one of them moves away from the other, the histogram bars become longer; If the moving averages get closer, the bars become shorter. Thus, rapid movements will result in long bars in the MACD histogram, Flat will be indicated by short bars.

If the histogram is above the zero line, it means that the fast moving average will be rising above the slow one, gradually moving away from it, which indicates an uptrend.

If the bars go below the zero line and the fast-moving average is below the slow one, it’s a downtrend. The auxiliary line, which sometimes intersects with the histogram in the indicator window, is the moving average that has been calculated based on the MACD histogram readings and not the price chart.

This line is designed to receive additional signals from the indicator. To avoid any confusion, let us call it a “MACD moving average”.

MACD Indicator set up

MACD is among the standard tools of MetaTrader 4, and the set up is done in just a few clicks.

The easiest way to do that is via the “Indicators” section in the trading platform’s upper menu:

After that the window with indicator settings will open:

Here you can set the main parameters of the indicator:

- Fast and slow MA are the moving averages. They are applied to the chart and provide the data for the histogram. The greater the difference between their periods, the more rapid changes the histogram will show. More often than not, these parameters remain default (unless a specific strategy requires otherwise).

- MACD SMA is a parameter of the MACD moving average itself. The higher the parameter, the further away the average will move from the histogram and they will intersect less often.

This parameter value allows to adjust the accuracy of the signal within a trading strategy: the higher the parameter value, the fewer signals there are. - Next, you need to set the parameter (open, close, candlestick’s highest and lowest values) which will determine the remaining criteria.

- Finally, you can fix the minimum and maximum parameters. The histogram will not go above or below them.

Other tabs will allow you to set the colour range, change the timeframe or add levels that are a straight line on an indicator (it’s set to “0” by default).

Additional levels might be required by a certain strategy for tracking the signals. For example, selling of an asset at the intersection of the top level on the chart.

Once the indicator has been set up and applied to the chart, you can start trading. There are both simple and more complex MACD trading strategies. To understand the MACD principle, let us look at some of these strategies.

Simple MACD strategy

The simplest MACD strategy does not require any additional indicators. MACD signals alone will be sufficient for determining the entry points.

With this strategy, the orders are opened as follows:

- If the MACD histogram crosses the moving average upwards, the buy order will be placed.

- If the MACD histogram crosses the moving average downwards, the sell order will be placed.

The recommended stop loss level is set below the minimum level of the candlestick that determines the entry point (when buying) and is above the maximum level when selling. The take profit should be three times the stop loss or at the closest key price level.

MACD convergence/divergence trading

MACD convergence/divergence signal is one of the strongest ones. Convergence is expressed in approaching of the moving direction of the MACD histogram and the price chart.

It looks like this:

The chart shows how the price movement slowed down after a strong downtrend, reversed and then went down again hitting a fresh low. At the same time, MACD indicator also shows a local minimum, but it is higher than the previous one. This signals that the movement is “exhausted” and it’s highly likely that the price will go upwards. Although it is now shown in the chart itself, the indicator signals in advance. This is exactly what makes it valuable.

Convergence trading is conducted in the following way:

- When the indicator “draws” the second minimum above the first one, you need to be ready to buy.

- The market entry occurs when the price reverse is confirmed by the break of the upper trend line (resistance).

Divergence differs from convergence in that the lines in the chart and at the top of the histogram do not converge but move in different directions (the chart line goes upwards whereas the line in the indicator window moves down).

In this case, if the price breaks the price channel support line, the sell order will be open.

MACD + МА strategy

To make trading more efficient, you can use other indicators together with MACD. The best option to complement the MACD oscillator would be a trend indicator. The most effective and simple one would be МА.

The buy and sell signals will then be as follows:

- If the price chart crosses the moving average downward and the histogram intersects with its average in the same direction, the sell order will be open.

- If both intersections have an upward direction, the buy order will be open.

There are fewer false entry points because the indicators filter each other’s signals. Although this system can also result in losses, they are compensated by bigger profits due to the strong trend.

Complex strategy with MA and RSI

The “the more indicators, the better” rule does not always work. However, the technical analysis experts agree that the trading charts can have up to five indicators. We will look at the strategy with three indicators: MACD, MA and the RSI oscillator. In this case, it is quite appropriate to use two oscillators. While MACD indicator will help determine the order opening direction, RSI will determine the optimum entry points.

It will allow not only to enter the market in the correct trend direction but also take maximum profit. You can opt not to open the position if the trend started weakening and you missed the chance.

The complex strategy allows to buy under the following conditions:

- The price chart intersects MA in the upwards direction.

- The MACD histogram crosses the moving average in the same direction.

- RSI enters the oversold zone (below 30) and then moves upwards.

If the situation is reversed, the sell orders will open.

In this case, RSI will act as a powerful filter that will prevent late market entry.

At the same time, MA and MACD will be filtering the false entries to the RSI oversold and overbought zones.

Conclusion

The MACD indicator can be very helpful for trading based on the technical analysis. However, it is not very efficient without other tools. Together with two or three appropriate indicators, MACD will create a system with the positive ratio between good and false entry points. This will ensure profit for the disciplined traders.

MACD Trading Strategies – FAQs

- What is the MACD Indicator?

The Moving Average Convergence Divergence (MACD) is a lagging indicator used to locate trends within the market. It consists of a histogram and two lines derived from moving averages. It is important to note that the moving averages used are exponential, and thus will give greater weight to more recent price action. This helps traders identify whether a trend is getting stronger or weaker based on the slope of the MACD lines. The histogram simply shows the difference between the two lines, giving a visual representation. Thus the histogram is positive when the faster EMA line is on top, and is negative when the faster EMA line is on the bottom.

- What is the best MACD setting for day trading?

Each trader has their own preferred MACD settings, but in general it is agreed that the best settings for day trading using the MACD are 3-10-16 and 5-34-1. That said, it is important to recognize that the MACD is a lagging indicator and really needs to be combined with another indicator to truly shine. Some popular combinations are the MACD with the MFI or TRIX, but the most popular combination is MACD with Bollinger Bands. All of this is to say that the settings for the MACD are important, but there are other considerations that will be of greater help when creating a successful day trading strategy.

- What is the best MACD trading strategy?

The best MACD trading strategy is the one that works best for you and this will differ based on the psychology and trading strategy of each individual trader. That said, there are a number of indicator combinations that work well with the MACD. One such is the MACD plus the MFI. This combines the crossover from the MACD with the overbought/oversold signals from the MFI. So, if the MFI gives a signal that an asset is overbought we simply wait for a bearish cross in the MACD and then go short. It works the same for oversold signals and going long. The exit signal is when the MACD crosses in the other direction.