Call option and Put option

Options are simply contracts.

Rather than buying (Call option) or selling financial assets such as stocks,ETFs, futures, currencies (FOREX), regulated instruments or CFDs, with options you simply trade contracts.

Vanilla options on foreign exchange market can be used to mitigate currency risk through currency hedging strategies.

For the sake of clarity, the CONTRACT is the OPTION while the ASSET that the contract refers to is called the UNDERLYING ASSET, making an option a derivative instrument.

There are two types of option contracts:

- CALL OPTION ⬆

- PUT OPTION ⬇

In finance, an option represent a particular type of contract that gives the holder the right, but not the obligation, to buy or sell the underlying asset at a specific price (called the “strike price”) and at a specific date (European options) or before a pre-set date (American options).

Like insurance contracts, the purchase of an option comes at a cost, called a “premium”.

The two types of Option

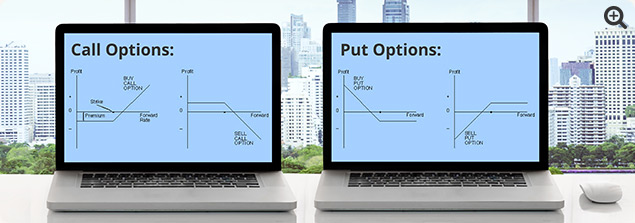

CALL OPTION

A Call option is a derivative instrument through which the buyer gains the right, but not the obligation, to purchase a determined underlying asset at a given strike price. In order to acquire this right, the buyer pays a sum called the premium.

Example

Asset A is currently priced at 30.0 dollars; you can pay a premium of 0.5 dollars which gives you the right to buy the asset in a month at 36.0 dollars. If in a month the asset price will be higher than 36.0 dollars (the buy – 30 – plus the premium – 0.5) it will be convenient to purchase the asset and to sell it on the market at a higher price (in the money). In the event, however, that the price of such an asset stays below or even drops there will be no point in exercising your right and you will therefore lose the premium (out of the money) you paid up front for the unexercised option.

PUT OPTION

A Put option is a derivative instrument through which the buyer gains the right, but not the obligation, to sell a determined underlying asset at a given strike price. In order to acquire this right, the buyer pays a sum called the premium.

Example:

Asset B is currently priced at 15.0 dollars; you can pay a premium of 0.5 dollars which gives you the right to sell it in a month at 10.0 dollars. If in a month the asset price will be below 9.50 dollars (10.0 strike price – 0.5 of the premium) such a transaction will result in a profit (in the money). In the event, however, that the price of such asset stays above or even surges there will be no point in exercising your right and you’ll therefore lose your premium (out of the money). In the case, finally, that the price stays between 10.0 and 9.5, it would be convenient to exercise the right granted by the option as at least part of the premium can be recovered (at the money).

Although there are only two types of options, the combination between option types (CALL Option /put), direction (buy/sell) and strike price can lead to a huge number of currency hedging strategies to effectively manage your trading and effectively counter currency risk.

What is the spread?

The spread is the difference between the so-called ask price (ASK) and the bid price (BID).

The first price is the price available for that particular asset to be purchased on the market.

The second is the price available for a particular asset to be sold on the market.

The spread is the cost of the transaction: put in other terms if you could instantly buy and sell a particular asset on the market you would be losing an amount of money equal to the spread.

- Movements of the spread – The spread between the Ask price and Bid price changes continuously. The greater the volume of trading (liquidity) or depth of the market, the lower the spread. They higher the volatility or price fluctuations, the higher the spread. In general terms, during the European and American trading sessions the increased market depth tends to reduce volatility, while after markets close in the USA and before the start of the Australian and Asian sessions market depth is narrower; and, therefore, during our Australian trading hours volatility may increase.

Orders

An order is simply an instruction given to an intermediary, such as a bank or a broker regulated with the AISC, to open or close a trade (buy or sell a security) and eventually reduce currency risk. There are different types of orders suiting your trading needs. For example, should you wish to enter into a trade immediately, you can use a market order, while if you wish to purchase a stock at a determined price or time, you can use a pending order.

- The main order types are – Market orders (MKT)

Market orders are instant orders that instruct your trading platform to buy or sell immediately at the best price available on the market at that time.

Pending orders

Pending orders are a specific type of order conditional upon the meeting of a determined criteria.

- LIMIT order – A limit order is an instruction to buy/sell if the price of an asset reaches a particular level that is more favourable than the current price; i.e. you wish to buy at a lower price than the one currently available on the market or sell at a higher price than the one currently available on the market.

- STOP order – A STOP order is an instruction to buy/sell if the price of an asset reaches a particular level that is less favourable than the price currently traded on that market, i.e. buying at a price that is higher than the one currently available or sell at a lower price than the one available.

- Good ‘Til Canceled – Good ‘Til Canceled (GTC) orders stay active (pending execution) until they are either executed according to the order’s conditions or cancelled by yourself. On a purely theoretical level, they remain valid “to infinity”.

Please note that some brokers consider GTC orders as DAY orders or valid until the end of the day. Others allow to indicate the expiry date.

What is leverage?

Leverage is a tool that allows the trader to take on exposure to a financial market or asset for an amount that is higher than his/her available capital. The ratio between the total value of assets you are trading and your capital is the amount of leverage you are using. Usually expressed in the format of 1:X, where 1 is your capital and X the leverage ratio, leverage is usually a derivative expression of the margin requirement.

Margin requirement is the amount of money needed to maintain a certain trade and is generally determined by the broker within the limits imposed by the Australian Securities and Investments Commission and is a percentage of the total value of an asset. So while your margin requirement is fixed, you can tailor your leverage and therefore your risk on the market.

For instance, you have a 10,000 dollars account and the margin requirement to maintain a lot (100,000 units) on AUDUSD is 1%. Therefore, you will need 1000 dollars to open a trade. However your leverage will be 100,000 AUDUSD divided by your investment (10,000) AUD and you are therefore exposed for 10 times your investment (1:10 leverage) while employing only 1% as margin.

Leverage amplifies your potential of making profits and losing money. Without it, you could buy only as much as your capital allows – in this case a 10,000 AUDUSD mini-lot or 1/10 of a lot. As the market rises 1% you will make 1% profit (or, conversely, a loss), while using the 1:10 leverage effect described above you could have made 10% profit but also 10% of loss.

If you wanted to be extremely more speculative, you could have used all your margin and exposing yourself 100 times your capital. In this case, taking your account of 10,000 dollars, you can buy or sell up to 1,000,000 AUDUSD. In this case your leverage is 1:100 which is given by your market exposure (1 million AUDUSD) divided by your investment of 10,000 dollars. As the market moves 1% in your can double your investment as well as completely wipe out your account balance.

It is easily understandable how leverage can increase your currency risk and therefore requires some sort of currency hedging. In fact, you don’t have to use all your available margin and you must consider that leverage is just a tool: it’s up to you to use it wisely.

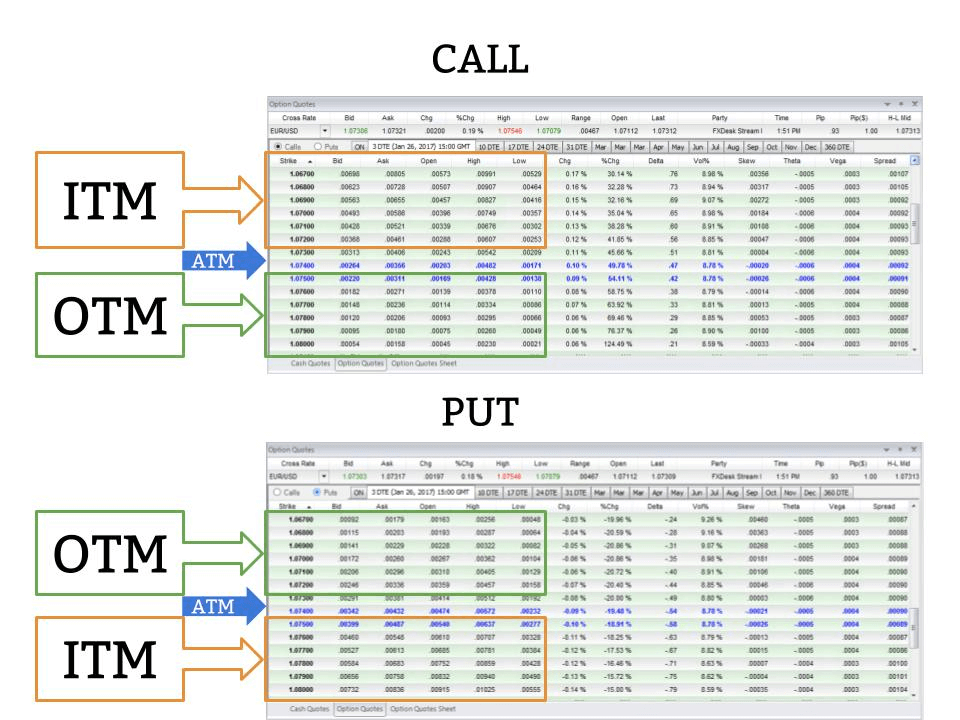

ITM, ATM and OTM

Let’s now talk about CALL options

Call options that have a strike price lower than the current price of the underlying asset are called IN THE MONEY – ITM.

Call options that have a strike price higher than the price of a determined underlying asset are called OUT OF THE MONEY – OTM.

The same reasoning applies to PUT options

Put options with strike price higher than the current underlying asset’s price are IN THE MONEY while put options with strike price below the current underlying asset’s price are OUT OF THE MONEY.

There is one last case where the strike price is in the area determined by the range between the strike price and the underlying asset’s price +/- the equivalent in price terms of the premium. This area is called AT THE MONEY where the underlying asset price is in a small area where it is not too low (call Option) or too high (Put Option) so that your premium will cover your trade, but at the same time not high enough (Call Option) or low enough (Put Option) to pay for the option premium and allowing a profit (in the money area).

Option Greeks

The set of variables that influence an option’s price are called Greeks as Greek letters are used to indicate such numbers:

Delta – change in the option price (premium) with respect to the movements of the underlying asset

Gamma – change in delta or acceleration of the change in the premium

Theta – measure of the temporal decay of the extrinsic value of an option

Vega – change in the premium with respect to the change in volatility

Currency Hedging Strategies, how can I reduce my currency risk?

Currency Hedging and options trading is becoming increasingly popular in Australia. Such structured trade is aimed at reducing currency risks and money management risks. With vanilla options you can structure a currency hedging trade without any stop loss and avoid that high volatility movements influence the outcome of your investment decisions. With just two types of options that can be sold or bought and a wide range of strike prices and time horizons the trader with AvaTrade Australia can create an almost infinite number of strategies.

CALL Option FAQ

- What exactly is a derivative option? I keep seeing this term everywhere but I don’t understand what it means?

In Forex trading, you will often see the term ‘derivative instrument’, ‘derivative’, or even ‘contract for difference’ as part of the literature on this topic. A derivative option is essentially derived from the price of the underlying financial instrument. Rather than trading the actual asset – USD/ZAR, gold, JSE (Johannesburg Stock Exchange), or SAB Miller Limited – you’re trading a contract which mirrors the pricing of the underlying financial instrument. These can be currency pairs, commodities, indices, or stocks. The price of the contract is derived from the price of the underlying financial instrument. That’s why it’s a derivative option.

- Is it better to use more leverage for less leverage?

When trading forex pairs, you must always be mindful of the unpredictability of the currency markets. Call options and put options have the propensity to surprise traders. When your trades finish in the money, and you are using significant leverage, you will be thankful that you did. If your trades finish out of the money, leverage can work against you. Consider this: when you use extremely high leverage, and the associated margin is less than X10 to X20 your costs, then the likelihood of a losing trade begins to increase sharply. When costs erode the margin, there is a high chance of your trades being closed out.

- What is the best way for me to trade the USD/ZAR currency pair?

The USD/ZAR is an exotic currency pair. It is less liquid than major currency pairs. As a result, its got a bigger spread, and is more expensive to trade. However, there is significant volatility with this pair. You can speculate on it, or hedge with the USD/ZAR. When you hedge a currency pair, you are protecting against unfavourable outcomes. A trader could go long on the USD/ZAR, and simultaneously hedge against negative price movements. Be on the lookout for potential breakouts, when prices move below resistance levels, or above support levels. Long candles are suggestive of potential breakouts.